All Categories

Featured

A financial investment car, such as a fund, would need to establish that you qualify as an accredited investor - accredited investor philippines. To do this, they would certainly ask you to load out a set of questions and possibly provide certain files, such as financial declarations, credit rating reports. accredited investor under regulation d, or tax returns. The benefits of being an approved investor consist of access to distinct financial investment possibilities not readily available to non-accredited investors, high returns, and boosted diversity in your portfolio.

In certain areas, non-accredited investors additionally deserve to rescission (potential investors meaning). What this indicates is that if an investor chooses they intend to take out their money early, they can claim they were a non-accredited capitalist the whole time and get their cash back. It's never ever a good concept to provide falsified records, such as phony tax obligation returns or financial declarations to a financial investment automobile just to invest, and this might bring lawful trouble for you down the line (accredited investor definition 2022).

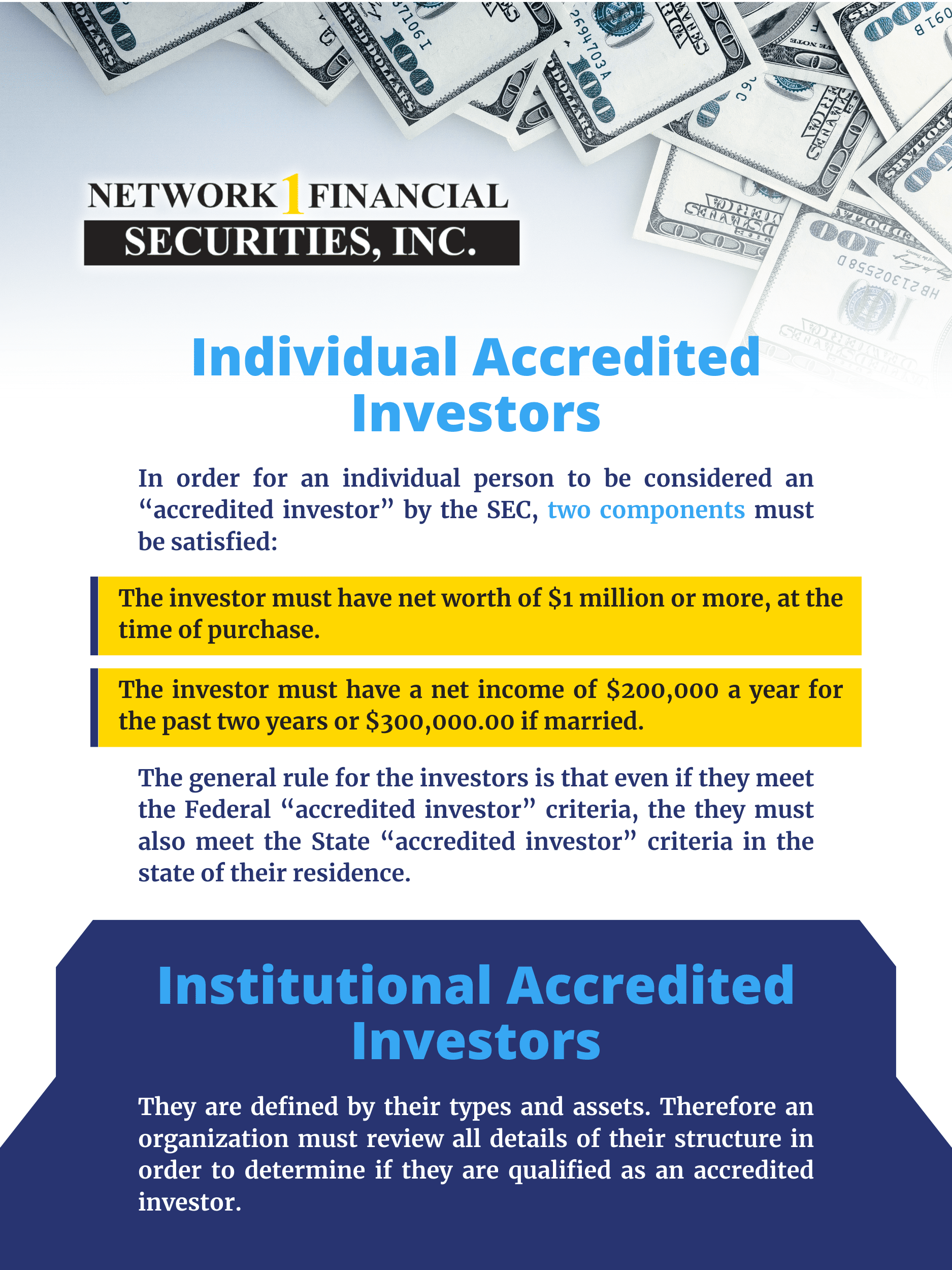

That being stated, each bargain or each fund might have its very own constraints and caps on investment quantities that they will certainly accept from an investor (definition of accredited investor). Approved financiers are those that meet certain demands regarding revenue, certifications, or total assets. They are typically rich individuals (family office accredited investor). Recognized financiers have the chance to spend in non-registered financial investments supplied by business like exclusive equity funds, hedge funds, angel financial investments (accredited investor definition sec), financial backing companies, and others.

Latest Posts

Back Taxes Owed On Homes

Real Estate Tax Foreclosure

Tax Liens For Sale Near Me