All Categories

Featured

Table of Contents

Financier with a special legal status A recognized or sophisticated financier is an investor with an unique standing under economic regulation laws. The interpretation of an accredited investor (if any type of), and the consequences of being categorized thus, vary between countries - accredited investor status. Generally, certified investors consist of high-net-worth people, banks, economic establishments, and other huge companies, who have accessibility to complicated and greater-danger investments such as equity capital, hedge funds, and angel investments.

It specifies sophisticated investors to ensure that they can be dealt with as wholesale (instead than retail) customers. According to ASIC, a person with an advanced capitalist certificate is a sophisticated investor for the objective of Chapter 6D, and a wholesale client for the objective of Chapter 7. On December 17, 2014, CVM provided the Instructions No.

A firm integrated abroad whose tasks are comparable to those of the companies laid out over (investor certificate). s 5 of the Securities Act (1978) specifies an innovative investor in New Zealand for the purposes of subsection (2CC)(a), an individual is rich if an independent chartered accountant licenses, no even more than twelve month before the deal is made, that the legal accountant is pleased on reasonable grounds that the person (a) has web assets of at the very least $2,000,000; or (b) had a yearly gross revenue of at the very least $200,000 for each and every of the last two fiscal years

Currently owners in great standing of the Series 7, Collection 65, and Series 82 licenses. natural persons that are "experienced staff members" of a fund with respect to private investments. limited liability firms with $5 million in assets may be accredited investors. SEC and state-registered investment advisers, exempt reporting advisers, and rural business investment firm (RBICs) might certify.

Family members workplaces with a minimum of $5 million in assets under monitoring and their "family clients", as each term is defined under the Investment Advisers Act. "Spousal matching" to the recognized investor interpretation, to make sure that spousal matchings may merge their finances for the purpose of qualifying as recognized financiers. Accredited investors have the legal right to purchase safety and securities that are not registered with regulative bodies such as the SEC.

"Suggestions for Adjustments to the SEC's Accredited-Investor Criterion - Lufrano Law, LLC". Archived from the initial on 2015-03-02 - professional investors definition. Recovered 2015-02-28. Firms Act 2001 (Cth) s 708 Firms Rules 2001 (Cth) r 6D.2.03 Companies Act 2001 (Cth) s 761GA"Certifications released by a certified accountant". Fetched 16 February 2015. "The New CVM Directions (Nos.

Accredited Company Definition

Fetched 2018-08-13. "Practical Law CA (New System) Signon". Gotten 2021-01-20. Health, Jason (7 December 2015). "Soon you will certainly be able to invest like the extremely rich, with all the incentives and threats". Financial Article. "EUR-Lex 32004L0039 EN". Official Journal L 145, 30/04/2004 P. 0001 0044. Kriman, Refael. ""Accredited Capitalist" New Change - Securities - Israel".

"Modifications to the "Accredited Financier" program in Singapore Lexology". www.lexology.com. Obtained 2021-01-20. "SEC.gov SEC Modernizes the Accredited Financier Interpretation". www.sec.gov. "SEC.gov Accredited Investors". www.sec.gov. 17 C.F (farmland investing for non accredited investors).R. sec. 230.501(a). This article incorporates message from this source, which is in the public domain name. "SEC.gov Frequently asked inquiries concerning exempt offerings". www.sec.gov. This article includes message from this source, which is in the public domain name

"What Is An Accredited Capitalist?". BAM Resources. Retrieved 7 February 2023. Hube, Karen (19 September 2023). "More Investors Might Obtain Accessibility to Personal Markets. Some Are Raising a Red Flag". Barron's. Iacurci, Greg (19 December 2023). "Inflation offers millions brand-new access to investments for the affluent, claims SEC". CNBC.

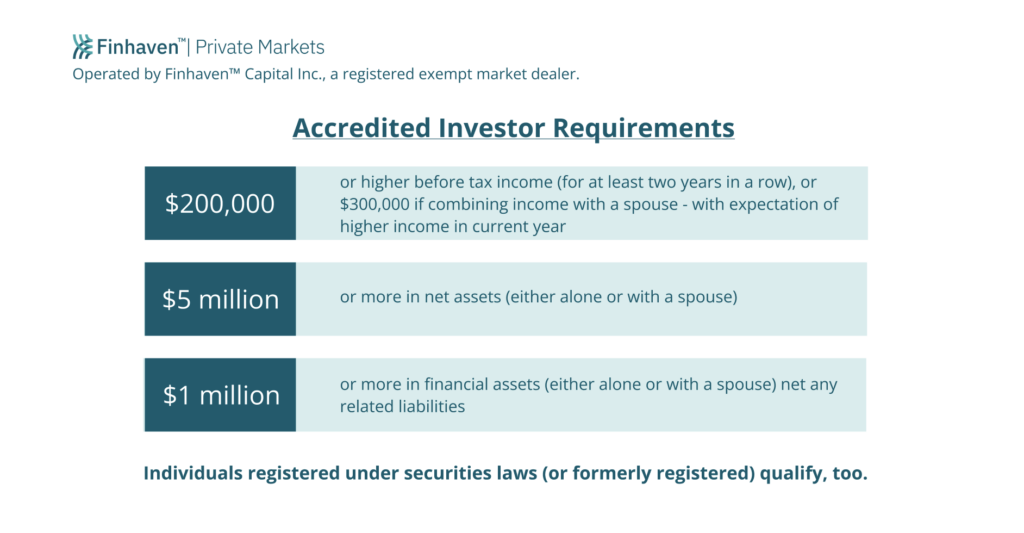

Accredited investors consist of high-net-worth people, financial institutions, insurer, brokers, and trusts. Accredited capitalists are defined by the SEC as certified to buy complex or sophisticated sorts of safety and securities that are not closely managed - accredited investor letter from cpa. Particular requirements should be fulfilled, such as having a typical annual earnings over $200,000 ($300,000 with a spouse or cohabitant) or operating in the economic sector

Unregistered safety and securities are naturally riskier because they lack the regular disclosure needs that come with SEC enrollment., and numerous deals including facility and higher-risk financial investments and instruments. A firm that is looking for to elevate a round of funding might make a decision to straight approach accredited investors.

It is not a public company but wants to launch a going public (IPO) in the near future. Such a firm could make a decision to provide safeties to recognized capitalists straight. This kind of share offering is referred to as a private placement. non accredited investing. For accredited financiers, there is a high possibility for risk or reward.

Accredited Investor Income Requirements

The policies for accredited investors vary among territories. In the U.S, the definition of an accredited financier is presented by the SEC in Guideline 501 of Law D. To be an accredited capitalist, a person has to have a yearly earnings surpassing $200,000 ($300,000 for joint revenue) for the last two years with the expectation of making the very same or a greater earnings in the existing year.

This quantity can not consist of a main residence., executive policemans, or directors of a firm that is providing non listed securities.

Qualified Purchaser Vs Accredited Investor

If an entity consists of equity proprietors who are certified capitalists, the entity itself is an accredited financier. However, an organization can not be developed with the single objective of acquiring details safeties. A person can certify as a certified investor by showing sufficient education or job experience in the monetary market.

People that desire to be recognized capitalists do not put on the SEC for the designation. qualified investor requirements. Rather, it is the responsibility of the business providing a private positioning to see to it that every one of those approached are recognized investors. Individuals or celebrations that wish to be recognized investors can come close to the company of the unregistered safety and securities

Private Placement Accredited Investors

For instance, expect there is a private whose earnings was $150,000 for the last three years. They reported a primary home worth of $1 million (with a home mortgage of $200,000), a car worth $100,000 (with an exceptional loan of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Web well worth is computed as properties minus liabilities. He or she's total assets is precisely $1 million. This entails an estimation of their properties (apart from their main residence) of $1,050,000 ($100,000 + $500,000 + $450,000) much less a vehicle loan amounting to $50,000. Given that they satisfy the total assets requirement, they certify to be an accredited investor.

There are a few much less usual credentials, such as handling a count on with even more than $5 million in properties. Under government safeties regulations, only those that are accredited investors may participate in certain safeties offerings. These may consist of shares in personal placements, structured items, and exclusive equity or hedge funds, to name a few.

Table of Contents

Latest Posts

Back Taxes Owed On Homes

Real Estate Tax Foreclosure

Tax Liens For Sale Near Me

More

Latest Posts

Back Taxes Owed On Homes

Real Estate Tax Foreclosure

Tax Liens For Sale Near Me