All Categories

Featured

An investment car, such as a fund, would certainly have to establish that you qualify as an accredited investor - real estate investing non accredited. To do this, they would certainly ask you to submit a survey and possibly supply specific documents, such as monetary declarations, credit history records. series 65 license accredited investor, or tax obligation returns. The benefits of being a certified investor include accessibility to unique investment possibilities not offered to non-accredited investors, high returns, and increased diversity in your profile.

In particular areas, non-accredited financiers additionally have the right to rescission (investor in usa). What this indicates is that if a capitalist determines they want to draw out their cash early, they can assert they were a non-accredited investor the entire time and get their cash back. It's never ever a good idea to supply falsified documents, such as phony tax returns or monetary statements to an investment car simply to spend, and this can bring legal difficulty for you down the line (falsely claim accredited investor).

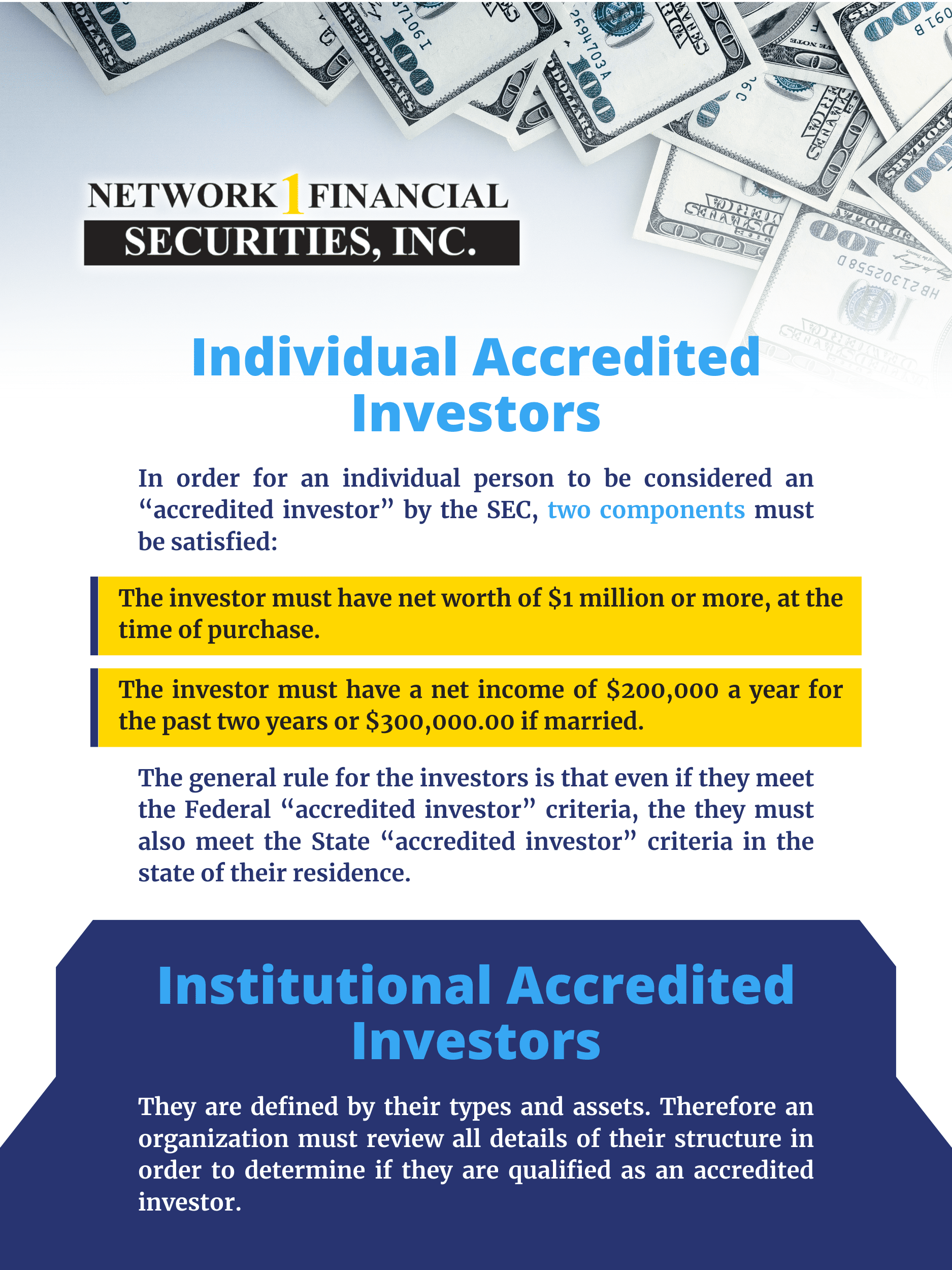

That being stated, each deal or each fund may have its own limitations and caps on investment quantities that they will certainly accept from a financier. Approved financiers are those that meet certain needs pertaining to income, certifications, or web worth.

Latest Posts

Back Taxes Owed On Homes

Real Estate Tax Foreclosure

Tax Liens For Sale Near Me