All Categories

Featured

You will certainly now need to look for the "overdue tax obligation" line for the previous tax obligation year to establish the quantity to sub-tax. A redemption declaration is an additional source utilized to figure out sub-tax purchase amounts.

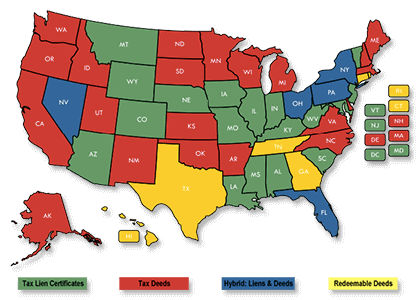

Real estate can be a rewarding investment, however not everybody wishes to manage the headaches that usually include owning and keeping rental building (investing in real estate tax liens). One means to buy realty without being a property manager is to acquire building tax liens. Annually, house owners in the U.S. fail to pay about $14 billion in building tax obligations, according to the National Tax Obligation Lien Organization

Tax Ease Lien Investments Llc

When a property owner falls back in paying real estate tax, the region or community might put tax obligation lien against the residential property. This makes certain that the residential property can not be re-financed or sold up until the tax obligations are paid. Rather of waiting for repayment of tax obligations, federal governments occasionally choose to market tax lien certificates to private financiers.

As the proprietor of a tax obligation lien certificate, you will certainly receive the rate of interest settlements and late costs paid by the property owner. If the house owner does not pay the tax obligations and fines due, you have the lawful right to confiscate on and take title of the property within a certain period of time (normally two years). So your revenue from a tax obligation lien financial investment will certainly come from one of 2 resources: Either passion payments and late fees paid by house owners, or foreclosure on the residential or commercial property occasionally for as low as cents on the dollar.

The interest rate paid on tax obligation liens varies by state, yet it can be as high as 36 percent annually. One more advantage is that tax lien certificates can occasionally be purchased for as low as a few hundred bucks, so there's a reduced barrier to entrance. You can expand your profile and spread out your risk by acquiring a number of different tax lien certificates in different real estate markets.

For instance, if the home owner pays the rate of interest and charges early, this will certainly reduce your return on the investment (tax lien investing texas). And if the property owner declares insolvency, the tax lien certificate will certainly be subordinate to the home mortgage and government back taxes that are due, if any type of. An additional risk is that the value of the property can be much less than the quantity of back taxes owed, in which case the home owner will certainly have little reward to pay them

Tax lien certifications are typically marketed via public auctions (either online or in individual) performed every year by area or community tiring authorities (investing tax lien). Offered tax obligation liens are commonly published a number of weeks before the public auction, together with minimal bid quantities. Check the internet sites of areas where you want buying tax liens or call the region recorder's office for a checklist of tax obligation lien certificates to be auctioned

Tax Lien Investment Companies

Remember that a lot of tax liens have an expiration date after which time your lienholder legal rights run out, so you'll need to move quickly to increase your possibilities of optimizing your investment return. Tax lien investing can be a rewarding way to spend in actual estate, however success requires comprehensive research study and due persistance

Firstrust has greater than a years of experience in supplying funding for tax lien investing, in addition to a committed team of certified tax lien experts that can help you leverage potential tax lien spending opportunities. Please contact us to find out more regarding tax obligation lien investing. FEET - 643 - 20230118.

Latest Posts

Back Taxes Owed On Homes

Real Estate Tax Foreclosure

Tax Liens For Sale Near Me